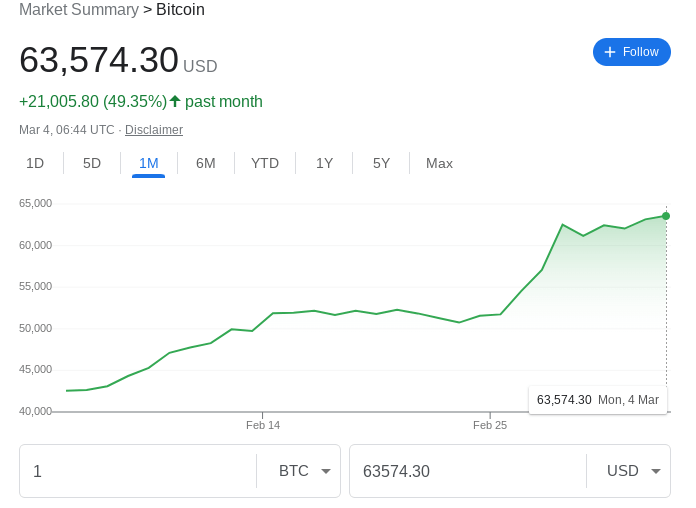

In the last 30 days we have seen Bitcoin rise 49% from around $42,500 to $63,500 as I write this. A couple of factors are behind this surge: increasing demand from mainstream financial institutions and increasing scarcity of both old Bitcoin and freshly mined Bitcoin.

Institutional Adoption of Bitcoin

The U.S. Securities and Exchange Commission (SEC) has had its reservations (to say the least) about Bitcoin, citing concerns about safeguarding investors and preventing market manipulation. However, there’s been a noticeabe shift in their stance lately. At the same time, big players such as BlackRock realize that Bitcoin could be a valuable addition to investment portfolios, helping to spread risk. This institutional adoption marks a pivotal shift in perception, as once-dismissed cryptocurrencies are now being embraced as legitimate investment vehicles.

These institutional players are allocating significant portions of their portfolios to Bitcoin, viewing it as a hedge against inflation and a store of value amidst economic uncertainty. This influx of institutional capital injects newfound legitimacy into the cryptocurrency space, fostering greater confidence among retail investors and fueling demand for Bitcoin, thus propelling its price upwards.

Supply Dynamics and Bitcoin Halving Events:

At the core of Bitcoin’s design lies a predetermined supply schedule, engineered to mirror the scarcity dynamics of finite resources. With a maximum of 21 million coins, Bitcoin’s issuance rate undergoes periodic adjustments through “halving” events, occurring approximately every four years.

These halving events serve as a deflationary mechanism, reducing by half the rate at which new Bitcoins can be mined. Consequently, the supply rate dwindles, creating scarcity just at a time when demand is increasing.

The next Bitcoin halving event is expected in April 2024. Historically, Bitcoin halvings have been catalysts for price surges, as market participants anticipate the impending reduction in new supply. This perception of scarcity, coupled with increasing demand can create a feverish atmosphere among speculators, which causes Bitcoin’s price to surge.

How Has The Bitcon Surge Affected HIVE?

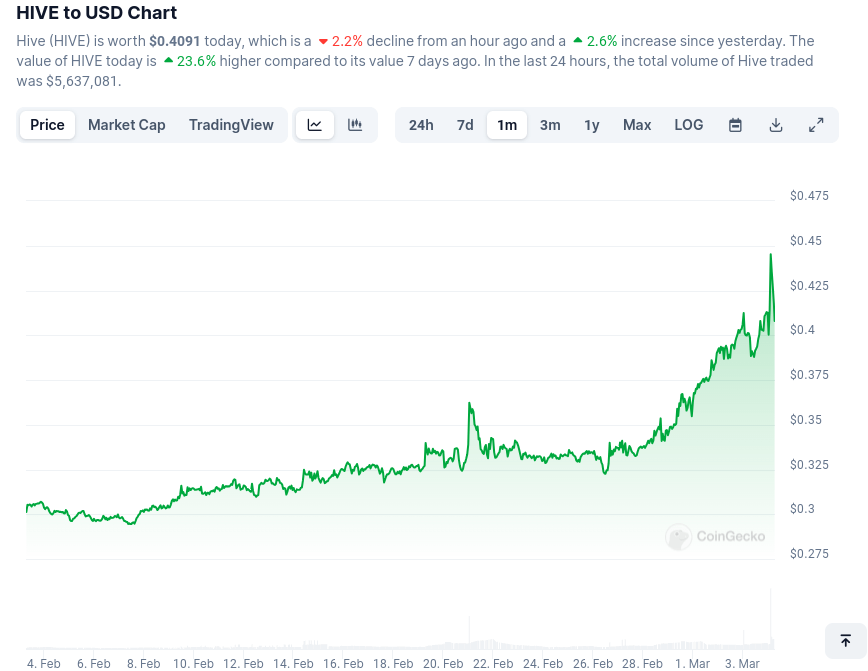

HIVE had been fairly stagnant as far as price was concerned over the last year or so, bumbling around the $0.26-$0.46 range, never sustaining any short-term rally. It began February languishing around $0.30 per token, but was dragged up in the wake of the Bitcoin rally to end the month in the mid thirties. In the first four days of March HIVE managed to break into the forties, touching $0.45 and making a 37% gain over the last 30 days.

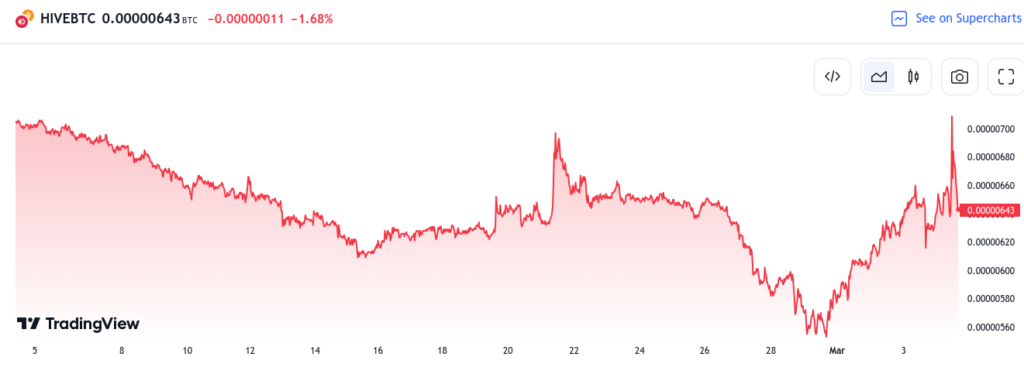

When we compare HIVE to Bitcoin, we can see that while HIVE has gained in value against the dollar, the faster rise of Bitcoin means HIVE has become cheaper to buy if you are buying with Bitcoin:

The tendency of HIVE to depreciate against Bitcoin can be seen even more markedly over the last five years as the chart below indicates. Yet, apart from the speculative surge way back in April 2020, Hive’s relative lack of volatility could be a point in its favour over the longer term:

HIVE As A Hedge Against Dollar Depreciation And Bitcoin Volatility

I am not a financial expert, and this is not financial advice, merely a blogger’s idle pontification, but even so… If you are holding Bitcoin and watching it sky-rocket… at some point you are going to want to cash out, even if only for a while. So what would you buy into? How about HIVE?

If HIVE is bouyant against the dollar but rising more slowly (and more steadily) than Bitcoin (until the next crash) then HIVE might be a good place to park your profits. When you power-up (stake) HIVE you currently earn approximately 2.84% per annum, subject to blockchain variance. In addition, your Hive Power helps you to earn HIVE from your content creation efforts on Hive.blog and other front-ends. Also, you can convert HIVE to Hive Backed Dollar (HBD), a stablecoin pegged to the US dollar that currently earns 20% per annum. If you were to time it right (LOL!), it could be very convenient towards the climax of the bull market to sell BTC for HIVE, and exchange some or all of your HIVE for HBD to earn 20% while waiting for Bitcoin to crash (assuming it ever will crash again…).

Some Hive Blockchain Second Tier Tokens Look Interesting…

In addition, the HIVE Blockchain supports a wide range of “second tier tokens” and associated projects.

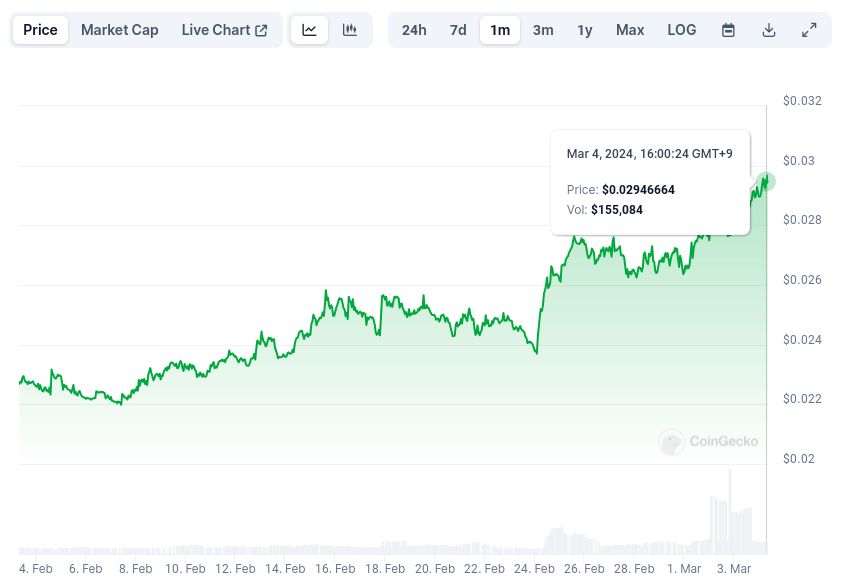

Now, while many of those tokens are worth little, several stand out as worth considering on the strength of the projects they support. For example, Splintershards (SPS), the token that underpins the exciting Splinterlands monster fighting NFT game, has risen by 30% over the last 30 days (see chart, below).

In addition, staked SPS currently earns 13.2% per annum. So you could cash out of your Bitcoin for SPS, and have some fun smashing monster NFTs’ heads together and earning SPS every time you win, while earning a nice interest rate on your stake!

Okay, with all that said, here is my Hive-Based Crypto Accumulation Report for February 2024

As you can see from the chart below, I had a pretty good February, especially for my HBD holdings, thanks to the power of affiliate marketing! I receive monthly profits from the Prosperity Marketing System and LiveGood in the form of Bitcoin, some of which I stash away, and some of which I send over to HIVE to help me hit my HBD target of 7,500 HBD by the end of 2025. (That number is not arbitrary, it gets me to the fifth rung of the 9-rung Hive Backed Dollar Freedom Ladder and well on the way to staking 120,000 HBD…)

I also made good progress towards my target for staked SPS – there is nothing like the satisfaction of being able to earn more SPS every time I smash another player’s NFT monster array!

I should also mention BBH as it looks like that token will the the first one to hit the 2024 target. I bought a bunch of them last month as they are supposed to be tied to BTC satoshi, among other reasons.

| Crypto Asset | 1st January | 31st January | 4th March | 2024 Target |

|---|---|---|---|---|

| HIVE Power | 3,438 | 3,484 | 3,527 | 7,000 |

| HBD | 1,346 | 1,543 | 2,001 | 7,500 |

| Staked SPS | 6,449 | 6,689 | 8,401 | 15,000 |

| CTPSB | 252 | 253 | 275 | 750 |

| LEN | 1,234 | 1,246 | 1,349 | 3,500 |

| Staked LEO | 1,518 | 2,035 | 2,269 | 3,500 |

| BBH | 1,046 | 1,829 | 8,067 | 10,000 |

| SWAP.BTC | 0.00012525 | 0.00012552 | 0.00018762 | 0.01 |

So, all told, February was quite a positive month, even if my content creation efforts on the Hive.blog were a bit lackadaisical. 😬

Cheers!

David Hurley

#InspiredFocus

P. S. Check out my Hive blog @ https://hive.blog/@hirohurl