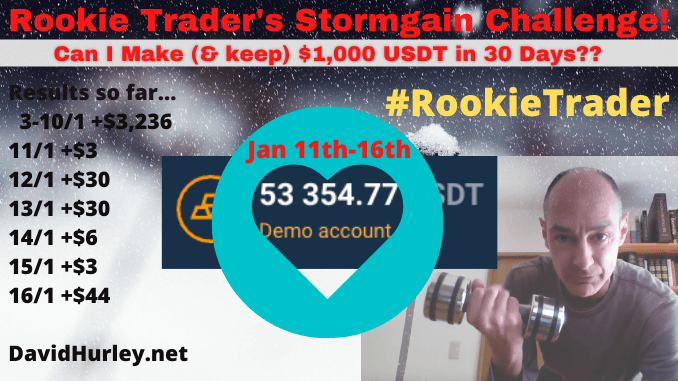

It’s been a few days since my last report on my progress as a #RookieTrader using a demo-account to train myself to trade crypto futures on the Stormgain platform.

So, how has the challenge been going?

Well, for one thing, I’ve been away from my computer a lot, and I have no intention of putting the Stormgain trading app on my phone at this stage.

However, I’ve made at least one trade per day over the last five days and the results, while not spectacular, have been encouraging. One does not despise the days of small gains.

I have managed to extend my winning streak from the last couple of trades I made on 5th of January all the way to today, 16th January. That has been achieved mainly by placing $100 trades with less leverage than before, usually 10x leverage, with the Auto Invest checked and the Stop Loss left off.

Here are my results since my previous report:

- 11th January = +$3.1324 (1 trade)

- 12th January = +$30.6743 (1 trade)

- 13th January = +$30.0492 (1 trade)

- 14th January = +$6.0501 (1 trade)

- 15th January = +$3.6888 (1 trade)

- 16th January = +$44.9921 (2 trades)

As a result, my profit has grown to $3,354.

To Stop Loss Or Not To Stop Loss?

When I started this challenge I assumed that I would be using stop-losses to protect myself, but my experience has been that stop-losses seem to guarantee the loss when the trade goes in the wrong direction. Most of my losses come from the trades being stopped out. The annoying thing is that the assets moved back and had I kept the trades open they would have been profitable.

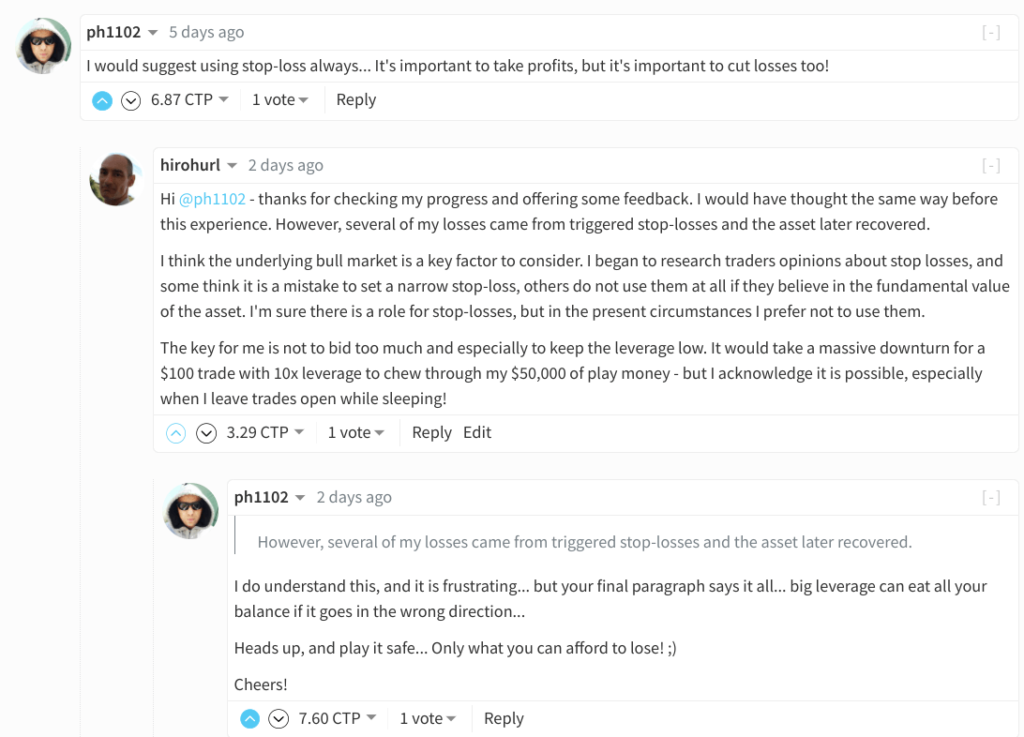

It is this question of the role of the stop-loss that prompted a nice exchange of ideas with a fellow member of the CTPTalk community who suggested that one should always use a stop loss to cut losses.

I replied that “I would have thought the same way before this experience. However, several of my losses came from triggered stop-losses and the asset later recovered.”

I continued,

“I think the underlying bull market is a key factor to consider. I began to research traders opinions about stop losses, and some think it is a mistake to set a narrow stop-loss, others do not use them at all if they believe in the fundamental value of the asset. I’m sure there is a role for stop-losses, but in the present circumstances I prefer not to use them.

“The key for me is not to bid too much and especially to keep the leverage low. It would take a massive downturn for a $100 trade with 10x leverage to chew through my $50,000 of play money – but I acknowledge it is possible, especially when I leave trades open while sleeping!”

Thinking About Taleb’s Barbell Strategy

One reason why I thought I would be using stop losses is because I admire Nicholas Nassim Taleb’s take on investing. In the specific type of trade that he works with he advocates setting up lots of positions with tight stop losses. The idea is to let the losers fall by the wayside, and take advantage of the big winners, which will do far more than cover for the losses.

However, I am not in a position to make and monitor multiple trades, and anyway, my trading instruments are quite different and blunter than his.

Also, on reflection, I realized that crypto futures trading could be at the “high risk” end of my barbell, with much lower risk and safer investments making up the other barbell. In that case, trading small, $100 positions on a $50,000 account, with leverage set low, and each asset sufficiently researched, it does not seem unreasonable to leave the stop loss off and the auto invest on if you are reasonably confident about the underlying strength of the asset you are trading.

That, at least, is where I am at right now in my thinking. Bear in mind, if it is not already painfully evident, that I am merely a #RookieTrader with no prior experience of investing, and am playing with a demo-account.

Come along for the ride as I try to learn how to trade my way to a profit!

If you are an experienced trader, any advice would be welcome. Let me know where I’m going wrong, or post some tips in the comments below.

Check out Stormgain at: https://fwd.cx/WmUzkey5BqVp

Looking for a safer way to accumulate and store bitcoin? This is what I use: https://freebitco.in/?r=37315680

David Hurley

#InspiredFocus

#RookieTrader !

Disclaimer: I am not a financial advisor and this is certainly not financial advice. Simply the musings of a rookie trader playing with pretend money…