Back in January I mentioned that I had narrowed my yearly crypto goals from 12 in 2023 to 8 in 2024. All eight tokens are built on the Hive.io Blockchain, where you can earn crypto for content creation and curation.

However, looking at my recent form, it is obvious that I am really only focussed on TWO Hive-based tokens, which are Hive-Backed Dollar (HBD), and Splintershards (SPS), the governance token of the Splinterlands NFT monster fighting game, where you can earn SPS when you defeat your enemies!

Dropping Swap.BTC

In January, I added Swap.BTC to my list of accumulation targets for 2024, but it has become clear that I am not seriously pursuing that token, so I sold off my meagre holdings for SPS and have dropped it from my list of token targets for 2024. So now the chart shows only 7 tokens.

However, it is unlikely that I will hit my targets on four of those tokens, and this does not bother me. The only two tokens I care about accumulating are HBD and SPS.

Climbing the HBD Freedom Ladder

HBD: I am still keen on climbing the Hive Backed Dollar Freedom Ladder by accumulating 120,000 HBD (equivalent of $120,000). HBD earns 20% interest per year, paid monthly. I will keep going all the time HBD is earning 20%. At 120k HBD, you’d earn 2,000 HBD per month in interest, and the compounding would also be very nice…

Of course, the interest rate could be voted down at any moment, but I ensure that all 30 of my votes go to witnesses who support the 20% interest rate.

13% Interest on Staked SPS

SPS: It was the high interest rate that staked SPS was earning that drew me into Splinterlands. Now, the interest rate is much lower, but still over 13%, and I’m addicted to playing Splinterlands every day, and swapping other 2nd tier tokens for SPS whenever I can. SPS has become the only other token, apart from HBD, that I am seriously seeking to accumulate.

Ditch the rest?

Okay, that is not to say that I’m going to ditch all the other tokens at all. I’m adopting a similar policy with them as I have for ALIVE and POB: I have no specific accumulation target, but aim to end the year with more of those tokens that I had at the beginning.

That seems to be the ACTUAL policy that I have towards all the other tokens on the list, as you can see by the slow rate of accumulation in all cases except for HBD and SPS:

| Crypto Asset | 1st January | 4th March | 1st April | 1st May | 3rd June | 2024 Target |

|---|---|---|---|---|---|---|

| HIVE Power | 3,438 | 3,527 | 3,553 | 3,581 | 3,638 | 7,000 |

| HBD | 1,346 | 2,001 | 2,142 | 2,185 | 3,014 | 7,500 |

| Staked SPS | 6,449 | 8,401 | 8,669 | 8,914 | 9,167 | 15,000 |

| CTPSB | 252 | 275 | 275 | 275 | 276 | 750 |

| LEN | 1,234 | 1,349 | 1,477 | 1,493 | 1,261* | 3,500 |

| Staked LEO | 1,518 | 2,269 | 2,273 | 2,275 | 2,280 | 3,500 |

| BBH | 1,046 | 8,067 | 8,088 | 8,307 | 8,627 | 10,000 |

*I Didn’t Sell Off LEN!

I made some progress in accumulating tokens across the board, except, it seems, for LEN…

Did I sell off LEN for HBD or SPS?

No!

Instead, I swapped some LEN for the LEN mining token, LENM, and chucked them into the Tribaldex LEN/LENM liquidity pool.

What Is A Liquidity Pool?

A liquidity pool is a pair of cryptocurrencies locked in a smart contract on a decentralized finance (DeFi) platform. These pools facilitate trading on decentralized exchanges (DEXs) by providing liquidity for various cryptocurrency pairs.

Liquidity pools offer high rates of interest through trading fees and additional rewards. These high yields are driven by the significant demand for liquidity in DeFi markets, which gives investors an incentive to become “liquidity providers” by investing pairs of crypto tokens into liquidity pools such as those offered by Tribaldex for 2nd tier Hive Blockchain tokens.

Liquidity Pool Goes Nuts?

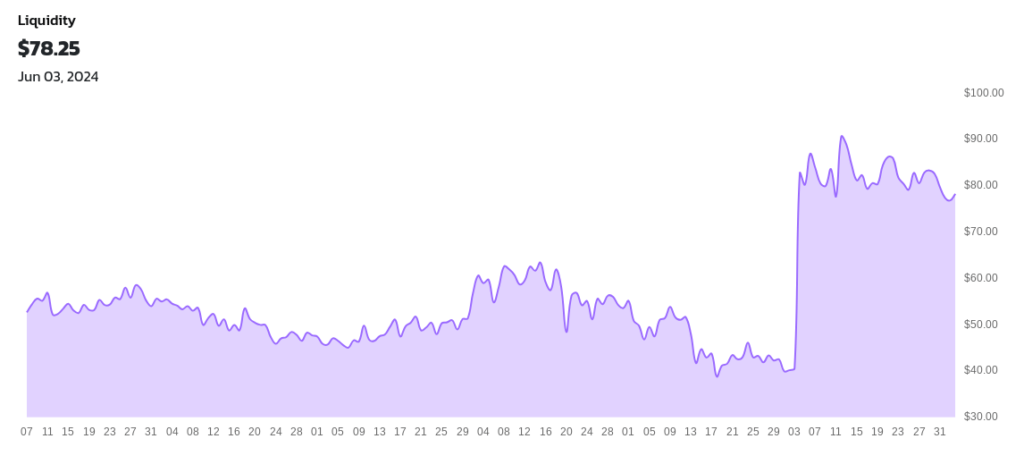

Speaking of Tribaldex liquidity pools, there’s a lot of volatility, but in May things went wild… the value of the pool shot up, then took several massive dives and recoveries, and is currently back up again…

Anyway, the big winner for May, and for the first five months of this year has been HBD. I’ve more than doubled my holdings since the beginning of the year, and I hope to more than double up again by the end of the year to hit the 7,500 HBD target… Once I’m there, it’s a case of doubling up until I hit 120,000 HBD on the top rung of the HBD Freedom Ladder!

Cheers!

David Hurley

#InspiredFocus